Salary calculator with tax deductions

Filers must also input dollar amounts for income tax credits non-wage income itemized and other deductions and total annual taxable wages. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

2022 Federal income tax withholding calculation.

. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Plug in the amount of money youd like to take home.

See where that hard-earned money goes - Federal Income Tax Social Security. But calculating your weekly take. The federal income tax has seven tax brackets which range from 10 to 37.

Hour Withholding Salary 52000 Federal tax deduction - 5185 Provincial tax deduction - 2783 CPP deduction - 2643 EI deduction - 822 Total tax - 11432 Net pay 40568. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Subtract 12900 for Married otherwise.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Which tax year would you like to calculate. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Is a progressive tax with higher rates being applied to higher income levels. It will confirm the deductions you include on.

The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax calculations and thresholds incremental allowances. How Your Paycheck Works. The above calculator assumes you.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding. You can enter your current payroll information and. This makes your total taxable.

It can also be used to help fill steps 3 and 4 of a W-4 form. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In 2023 these deductions.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. For the most part these W-4 changes mainly.

Pin En Canada

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Payroll Calculator Template For Ms Excel Excel Templates

Pin On Raj Excel

Understand Salary Breakup In India Importance Structure And Calculation Asanify In 2022 Salary Calculator Good Employee Understanding

Hra Exemption Calculator To Calculate One S Hra Deduction Gst Guntur Deduction Dearness Allowance Tax Rules

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

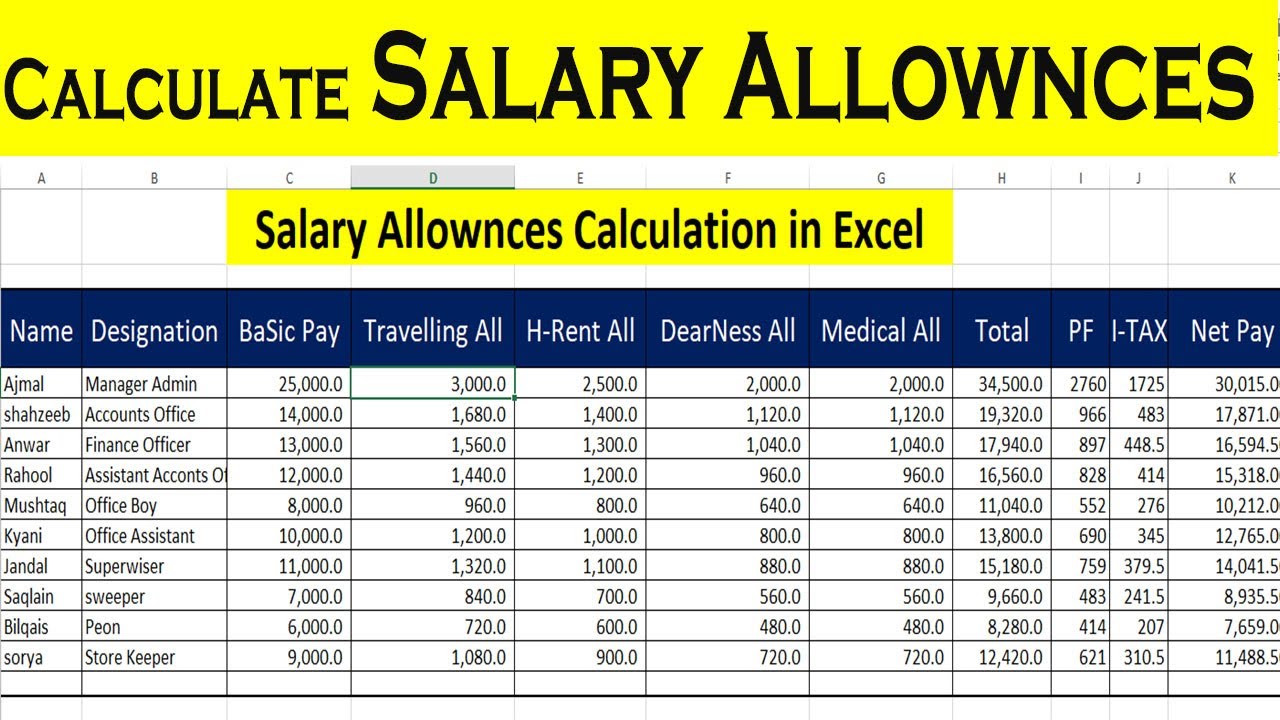

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro Income Tax Interest Calculator Credit Card Interest

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Employee Payroll Information Payroll Calculator And Payroll Invoice In 2022 Invoice Template Payroll Federal Income Tax

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary